premium loan life insurance

Premium financing can provide for the purchase of. For example a client is purchasing a policy with a premium of 100000 per year.

Types Of Individual Life Insurance Life Insurance Policy Term Life Life Insurance Companies

Premium financing is potentially.

. It really is an advance of money that the carrier will have to pay out from the terms of the life insurance policy. Life insurance premium financing Adding a borrowing strategy to your estate plans can protect your heirs in the futureand your financial position today. This is done by trying to convince the insured and the insureds advisors of how cheap the coverage is since they are only paying interest on the loan.

Life Insurance Premium Finance. Premium financing is a strategy that involves taking a loan and using the proceeds to pay policy premiums and in some cases the interest on the loan itself during an insureds lifetime. It is a specific clause or rider within the policy that allows the insurance issuer to withdraw premium payments from the accrued value of the policy when the policyholder is unable to or neglects to continue paying.

Life insurance premium finance loans are made annually on the policy anniversary when premiums are due. And while most cash value life insurance allows for loans there are conditions attached to them including paying interest often 5 or. 100 online or with a licensed agent.

This means that if you are unable to make your loan payments due to injury or death it can cover those payments for you. 100 online or with a licensed agent. Budget-friendly life insurance with no medical exam.

Holland Knights Life Insurance Premium Finance Team represents institutional clients through loan structures quality documentation advising on trust formation intergenerational planning insurance policy and collateral matters. All too often life insurance agents attempt to use life insurance premium financing as a way to make a sale. Steven Goodman Life Insurance.

Premium financing is a strategy that involves taking a loan and using the proceeds to pay policy premiums and in some cases the interest on. It is important to remember that premium financed insurance is not the same thing as free insurance. An automatic premium loan APL is an insurance policy provision that allows the insurer to deduct the amount of an outstanding premium from the value of the policy when the premium is due.

The insurance companies structure-specific insurance products for these financed plans to minimize outside collateral and maximize returns. They borrow the 100000 at 5 interest resulting in an out-of. Marketable security assets and the net cash surrender value CSV of the underlying insurance policy secure the loan.

Premium Financing Basics. Premium insurance financing enables high net worth individuals HNWI to obtain life insurance at minimal cost by arranging financing from a lender to cover the policy premiums. The bank loan pays the life insurance premiums for a defined period of time and then the policy becomes paid up no more premiums.

Ad Affordable life insurance with no medical exam. The policys face value is not affected by the automatic premium loan. The loan balance would increase to 58320 if the loan interest is borrowed again 54000 loan balance plus the loan interest of 4320.

An automatic premium loan is often associated with a life insurance policy that has a cash value. Life Insurance Corporation of India currently charges a rate of interest at 9 that needs to be paid half-yearly. Our experienced attorneys provide counsel to lenders in refinancings of existing.

The client may have to pay lifetime gift taxes on outright gifts to the ILIT because they have used all of their lifetime gift exemptions and annual gift tax exclusions. HNWIs are unlikely to want to liquidate assets to pay for such premiums and therefore opt for premium financing. In most plans premiums are made over a 7 to 10-year period.

Life insurance collateral loans typically have lower interest rates than you would get with a personal loan or credit card. The automatic premium loan is usually an optional clause of the life insurance policies. The premium for a life insurance policy is calculated using illustration software provided by the insurance company.

Life insurance premium financing is a strategy whereby a qualified borrower accesses third-party financing to pay for large life insurance premiums. The number of years premium is owed will vary based on the needs of the client and plan design. 100 online or with a licensed agent.

Ad Affordable life insurance with no medical exam. Loan protection insurance is a type of life insurance that protects your loan payments in the event of an accident or death. Typically you will use your life insurance to pay for estate taxes.

Life insurance premium financing should never be the reason any one purchases life insurance. Premium financing concerns borrowing money to pay life insurance premiums. Premium financing is often used when a life insurance policy is owned by an entityfor example an irrevocable life insurance trust ILITwhich may not have enough cash or assets to make large premium payments.

Budget-friendly life insurance with no medical exam. This allows individuals and businesses to leverage current. While rates vary they typically fall within the range of 6 to 8 again depending on who holds your insurance and your policy.

However it accumulates interest similar to other loans. Your life insurance policy loan is not a real loan in the classic sense. The rate of interest of bank loans is between 10-14 based on the type of insurance and tenure of the loan.

There are some non-guaranteed financial advantages to a financing large premiums for life insurance owned by an ILIT. Life Insurance Premium financing is a way to fund life insurance with a bank loan. This is because the life insurance policy owner has not agreed to repay the cash that has been transferred from the insurer even though interest is charged.

What is Premium Financing. Although premium financing may seem like a simple concept it actually involves complex transactionsand risk. 100 online or with a licensed agent.

The clause minimizes the risk of an insurance policy becoming lapsed due to neglected payments. Understanding the Life Insurance Premium Finance Loan. While there may be multiple reasons to employ this strategy it is often used to avoid liquidating other investments to pay premiums.

1 Informal modeling of your premium financed life insurance strategy. The premium amount is determined by a number of variables including your age. Youve just bought a home or car taken out a personal loan or received a new credit card.

For the executors of your estate paying death taxes may precipitate a liquidity crisisforcing them to hastily sell assets that would otherwise be inherited by your beneficiaries or resulting in other undesired outcomes. 7 Steps to take with your Premium Financed Life Insurance Agent Proper Sequencing Premium financing is an extensive process with multiple moving parts where the sequence and timing should be orchestrated by a specialized premium finance life insurance agent.

Smoking And Insurance Statistics In The Uk Affordable Life Insurance Infographic Health Life Insurance Policy

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Calculator Life Insurance Premium Income Tax

High Cash Value Life Insurance The Infinite Banking Concept Life Insurance Insurance Infinite Banking

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Mortgage Mortgage Mortgage Loans

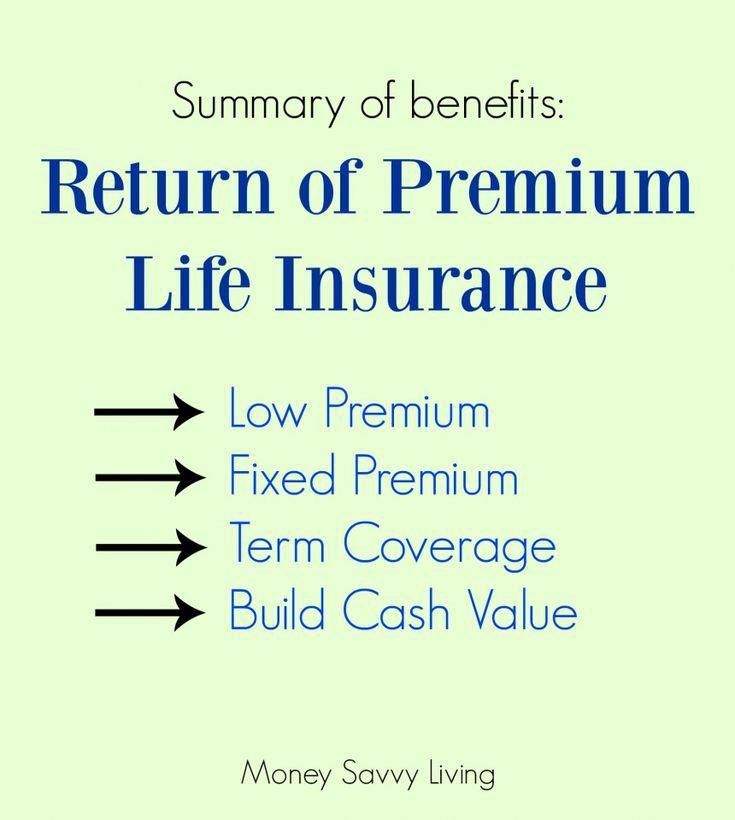

What Is A Return Of Premium Life Insurance Policy And Why You Should Consider Getting One Money Savvy Living Life Insurance Facts Money Savvy Life Insurance Policy

Why Insure Your Home Loan Home Loans Buy Life Insurance Online Life Insurance Policy

Free Financial Planning Life Insurance 301 Universal Life Policy Universal Life Insurance Life Insurance Financial Planning

Lic Policy Status Online Life Insurance Policy Online Registration Form Policies

Life Insurance Company Offers Range Of Tools Life Insurance Premium Calculator To Help Life Insurance Calculator Financial Decisions Life Insurance Companies

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing Usda Loan Kentucky Usda Mortgage Lender For Rural Housing L Usda Loan Mortgage Loans Usda

Edmond Consulting Group Llc Premium Financing Finance Life Insurance Policy Finance Loans

Buying Life Insurance Buy Life Insurance Online Life Insurance Policy Insurance Policy

Gmc Bank Insurance Plan For Life Preparing For Retirement Debt Investment

Afinoz Life Insurance Quotes Whole Life Insurance Insurance Quotes

Life Insurance Need At 25 Life Insurance Quotes Life Insurance Marketing Ideas Life Insurance Facts

Life Insurance Loans A Risky Way To Bank On Yourself Life Insurance Companies Life Insurance Life Insurance Premium

Mortgage Insurance When Do You Pay It Mortgage Private Mortgage Insurance Usda Loan

What Is Term Insurance Everything You Need To Know Term Insurance Life Insurance Policy Life Insurance Companies